Important updates to the Residential Tenancies Act

The Residential Tenancies Amendment Act introduces significant changes to tenancy laws in New Zealand. Here's a breakdown of the current laws and the upcoming changes, so you can understand how these amendments impact your rights and responsibilities as a landlord.

The Residential Tenancies Amendment Act introduces significant changes to tenancy laws in New Zealand. Here's a breakdown of the current laws and the changes that have come into effect as of January 30, 2025, so you can understand how these amendments impact your rights and responsibilities as a landlord.

Tenancy terminations

Current law

Landlords cannot end a periodic tenancy without providing a reason, such as:

Carrying out extensive repairs, refurbishment or redevelopment or demolishing the property (90 days’ notice)

The property is being sold or has been sold and the purchaser requires vacant possession (90 days’ notice)

The property is being occupied by the landlord or their family (63 days' notice) and is their principal place of residents for at least 90 days

The property is required for an employee (as stated in the tenancy agreement, 63 days' notice)

Tenants can terminate periodic tenancies with 28 days' notice

Fixed-term tenancies automatically convert to periodic tenancies unless a landlord gives notice using one of the specific termination grounds (above), a tenant gives at least 28 days’ notice before the end of the tenancy, or the parties agree to renew or end the tenancy.

New law (effective 30 January 2025)

'No Cause' Terminations reintroduced: Landlords can end periodic tenancies without providing a specific reason by giving at least 90 days’ notice

Reduced Notice Periods for Specific Situations

42 days’ notice: If the property has been sold with vacant possession, required for the owner or their family member as their principal place of residence (within 90 days of the tenancy ending and remain for at least 90 days), or needed for an employee (and this is stated in the tenancy agreement)

21 days’ notice: Tenants can now end periodic tenancies with just 21 days’ notice

Fixed-term tenancies: These will automatically convert to periodic tenancies unless either party provides notice between 90-21 days before the term ends, or the landlord and tenant agree to renew or extend the fixed term. Reasons are no longer required to end fixed-term tenancies

There will be a 90-day transition period for existing fixed-term tenancies, meaning the change will only apply to existing tenancies where they expire on or after 1 May 2025.

Retaliatory termination notes

Current law

Within 28 days of receiving a termination notice, a tenant has the right to apply to the Tenancy Tribunal for an order declaring that the notice is retaliatory, an unlawful act (financial penalties apply), and ‘of no effect’ (cancelled). This is on the grounds that the landlord gave the termination notice in response to the tenant enforcing their rights.

New law (effective 30 January 2025)

Up to 12 months after receiving a termination notice, a tenant can apply to the Tenancy Tribunal for an order declaring the notice retaliatory and an unlawful act if it was given in response to the tenant enforcing their rights or due to legal actions taken against the landlord. If the tenant applies within 28 days of receiving the notice, they can also request that it be cancelled.

Speak to your Harcourts Property Manager for advice before terminating a tenancy. They will advise you on what notice is appropriate and whether you should provide a reason for termination based on your specific circumstances.

Minor and technical amendments

From 20 March 2025, several updates to the Residential Tenancies Act 1986 will take effect, improving clarity and support for landlords and tenants.

Key changes include:

Prohibiting smoking indoors (of smoked tobacco products): Landlords can enforce clauses banning smoking indoors and, where consistent with the tenants’ rights and obligations under the Act, in other parts of the premises

Note: it is unlikely that vaping could be included in this prohibition, as vaping typically involves the use of an electronic device that heats a liquid to create a vapor that is inhaled. While vaping can involve nicotine, it does not usually contain tobacco.

Streamlining tribunal decisions: The Tenancy Tribunal can decide cases based on submitted documents, reducing the need for hearings

Family violence protections: Clarifying that a tenant can exit a tenancy at short notice if a dependent has experienced family violence

Consolidated applications: Tribunal jurisdictional limit set at $100,000 per tenancy for consolidated cases

Modern notice delivery: Electronic address or service has been extended to not only include email addresses, but now includes messages sent via texts or instant messaging

Extended address for service: If an email address was included as an address for service in a tenancy agreement, it can be used for up to two years after the tenancy ends

Extended rent reductions: Tenancy Tribunal rent reduction orders extended to 12 months, aligning with rent increase rules.

These changes ensure the Act remains fair, clear and effective for all parties.

Pets in rentals

Current law

Landlords can refuse tenant requests to keep pets for any reason

Total bond permitted cannot exceed four weeks rent.

New law (effective date to be set by Order in Council – expected late 2025)

Note: These changes do not impact any pets that are already kept in a rental property before the changes take effect

Written consent for pets: Tenants must seek written approval to have pets. Landlords must respond to the request within 21 days and may only refuse on reasonable grounds, such as property suitability or when a relevant rule or bylaw prohibits the pet from being kept on the premises

Pet bonds: Landlords can charge a pet bond of up to two weeks’ rent to cover potential pet-related damage

Liability: Tenants will be fully liable for careless and accidental pet-related damage that is beyond fair wear and tear

Conditions for pets: There will be a non-exhaustive list of reasonable conditions that can be attached to a landlord’s consent, including:

Professionally clean carpets

Restrain pets during inspections.

Disability assist dogs: These dogs are excluded from the pet bond and pet consent rules, as landlord’s permission is not needed, and a pet bond cannot be charged. Harcourts position is that Disability Assist Dogs are always good boys (or girls).

The changes include pet consent and bond-related infringement offences, unlawful acts, and associated penalties to support compliance with the new rules.

Harcourts is introducing a comprehensive Pet Policy to clarify the rights and responsibilities of landlords and tenants under the recent changes to the law. While the Residential Tenancies Act 1986 will permit pets with reasonable conditions, compliance with other legislation, such as the Dog Control Act 1996, is also required. Additionally, property managers will ensure adherence to local council bylaws, including dog registration requirements and restrictions on the number of dogs allowed at a property.

If your property is part of a body corporate, its rules may prohibit the keeping of pets, regardless of other permissions.

These changes are a positive step forward, as they hold tenants accountable for any damage caused by pets, allow for a higher bond to cover potential issues, and enable landlords to set reasonable conditions. The introduction of penalties is also welcomed, ensuring that tenants who fail to meet their obligations under the Act can face fines.

Online bond lodgement

Current law

Bond lodgement can be completed using physical forms and signatures.

New law (effective 17 December 2024)

All bond lodgements and payments must be done online, eliminating the need for signatures. This streamlines the process for both landlords and tenants

Further work on modernising the bond service will include bond refunds and other transactions.

What doesn’t change

The Government has kept some amendments made in 2020, as they give more choice to landlords on how to manage their property:

• Landlords can apply to the Tenancy Tribunal to end a periodic tenancy where the landlord has given three notices of anti-social behaviour in 90 days or where the tenant has been in repeated rent arrears

• Landlords can apply to the Tenancy Tribunal to end a periodic tenancy quicker than 90 days - on hardship grounds

• Landlords can end a tenancy with 14 days’ notice where the tenant has assaulted the landlord, their family or an agent, and a criminal charge has been filed.

The Government has upheld the 2020 amendment designed to protect tenants, allowing them to withdraw from a tenancy if they are victims of family violence. These provisions now extend to any dependents who are affected by family violence.

Your Harcourts property manager will guide you on the most suitable termination grounds to achieve the best outcome in the shortest amount of time.

At Harcourts, we are committed to empowering our network with the knowledge and tools needed to navigate the recent amendments to the Residential Tenancies Act. To support this, we are hosting a series of training and events across New Zealand in February. Alongside ongoing support, we will ensure our teams are well-versed in the latest changes and understand how these amendments impact both landlords and tenants. By keeping our network up-to-date with the latest legal requirements and best practices, we enable them to minimise risks while delivering exceptional service.

The Importance of Having Up-to-Date Insurance in New Zealand: A 2024 Perspective

When reviewing your home insurance, it's crucial to stay informed and proactive. Make sure your policy covers the full replacement cost of your home, especially with rising construction costs. Don’t overlook the importance of natural disaster coverage, given New Zealand's susceptibility to earthquakes and floods. Keep your contents insurance up-to-date, consider adequate liability protection, and always understand the fine print of your policy. By regularly reassessing your coverage, you can ensure your home and assets are well-protected against unforeseen events.

Always be prepared

In 2024, the importance of keeping your insurance policies current in New Zealand cannot be overstated. With our unique geographic location and climate, Kiwis face a range of natural hazards, from earthquakes to floods. As the frequency of extreme weather events increases, ensuring your insurance is up-to-date provides crucial financial protection and peace of mind.

Recent economic shifts, including rising interest rates and inflation, also impact the cost of living and rebuilding after a disaster. Ensuring your coverage reflects current property values and construction costs is essential. This year, many New Zealanders are reassessing their policies to align with the changing economic landscape, ensuring they are not underinsured.

Additionally, updated insurance can offer new benefits and protections tailored to emerging risks. As we move further into 2024, staying informed and proactive about your insurance policies is a smart move, safeguarding your assets and ensuring resilience against unforeseen events.

For personalized advice, reach out to your insurance provider or consult with a professional to review and adjust your coverage as needed. Protect your future by staying ahead today.

5 Essential Tips for Homeowners When Reviewing Their Insurance

Evaluate Replacement Costs: Ensure your insurance policy covers the full replacement cost of your home. Construction costs and property values can change rapidly, so reassess your coverage limits to avoid being underinsured. Consider getting a professional appraisal to determine accurate replacement costs.

Review Natural Disaster Coverage: New Zealand is prone to earthquakes, floods, and other natural disasters. Verify that your policy includes adequate coverage for these events. Check the specifics of your earthquake insurance and understand any exclusions or limitations related to natural disasters.

Update Your Contents Insurance: Regularly update the inventory of your home's contents and their values. High-value items like electronics, jewelry, and artwork may need additional coverage. Document your belongings with photos or videos to streamline the claims process if needed.

Consider Liability Protection: Ensure your policy includes sufficient personal liability coverage. This protects you in case someone is injured on your property or if you accidentally cause damage to someone else's property. Assess the coverage limits and consider an umbrella policy for additional protection.

Understand Policy Terms and Conditions: Take the time to read and understand the terms and conditions of your insurance policy. Be aware of deductibles, exclusions, and claim procedures. Ask your insurer to clarify any ambiguous points and ensure you know what is and isn't covered.

Regularly reviewing and updating your home insurance policy ensures you are adequately protected against unforeseen events and helps you avoid financial setbacks. Stay informed and proactive to safeguard your home and assets.

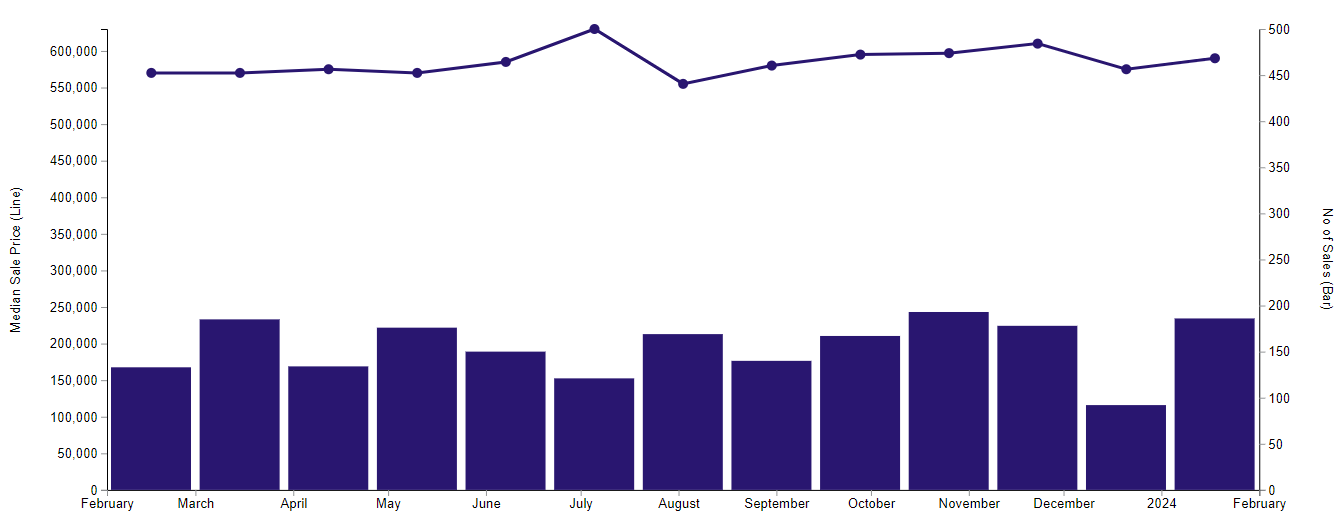

Dunedin Market Report - February 2024

The Dunedin median price for February was $590,000, up from $575,000 in February 2023, consistent with the last 12 months of results. It appears that our predictions that Dunedin has found its new normal seem well founded, at least for now until we see any significant reductions in mortgage interest rates.

The Dunedin median price for February was $590,000, up from $575,000 in February 2023, consistent with the last 12 months of results. It appears that our predictions that Dunedin has found its new normal seem well founded, at least for now until we see any significant reductions in mortgage interest rates

A positive for sellers was the median number of days on the market at 39 which is 23 days fewer than last February. If you’re currently for sale and taking much longer than this to sell, it may be time to revisit your asking price expectations, presentation or investment in marketing. There’s little point staying on the market and helping other homes around you sell.

Despite the large number of available homes for buyers to choose from (677 at this time) the median days and the number sold in February prove that buyers will act if they see value. There were 186 sales. A substantial increase of 39.8% compared to February 2023.

There are looming changes to government policy, but also reserve bank lending policy, and it will be interesting to see what affect these have on our market. In many ways they may balance each other out. The reintroduction of interest tax deductibility will help some investors, while the change to a 2 year bright line will ease some concerns over investment.

However, introducing debt to income ratios of 6 x income for owner-occupier lending and 7 x income for investment lending (with an exclusion for new homes) will no doubt affect the borrowing capacity of many smaller investors.

Our advice for buyers, act now. You have a great selection to choose from and prices seem unlikely to come down. Our advice for sellers, make sure your home is well presented and priced correctly so you can move on with your future plans while the market remains stable.

Dunedin Stats Graph median and volume of sales. Source REINZ